Best replacements for It's Deductible

When Intuit discontinued It's Deductible in October 2025, taxpayers were left searching for alternatives to track donations and meet IRS requirements. Without automated tools, managing charitable contributions - especially for itemized deductions - became more challenging. Luckily, there are three standout options to simplify donation tracking and ensure compliance:

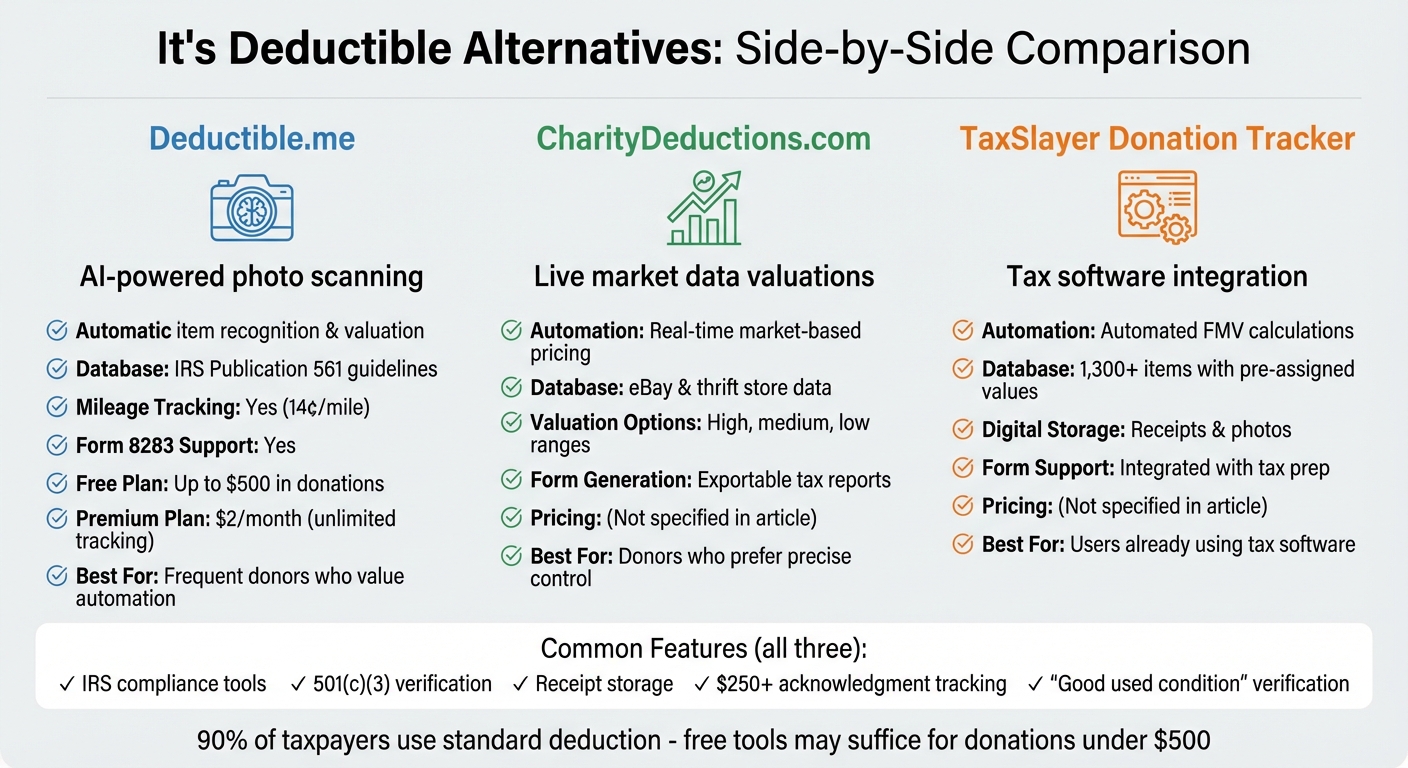

- Deductible.me: Uses AI to assign values to donated items via photo scanning, tracks mileage, and generates IRS-compliant reports. Free for up to $500 in donations; $2/month for unlimited tracking.

- CharityDeductions.com: Pulls live market data (eBay, thrift stores) for precise valuations and offers exportable tax reports.

- TaxSlayer Donation Tracker: Automates valuations for over 1,300 items, stores digital receipts, and integrates with tax software.

These tools help you stay organized, save time, and avoid errors during tax season. Whether you need AI, live market data, or tax software integration, there's a solution tailored to your needs.

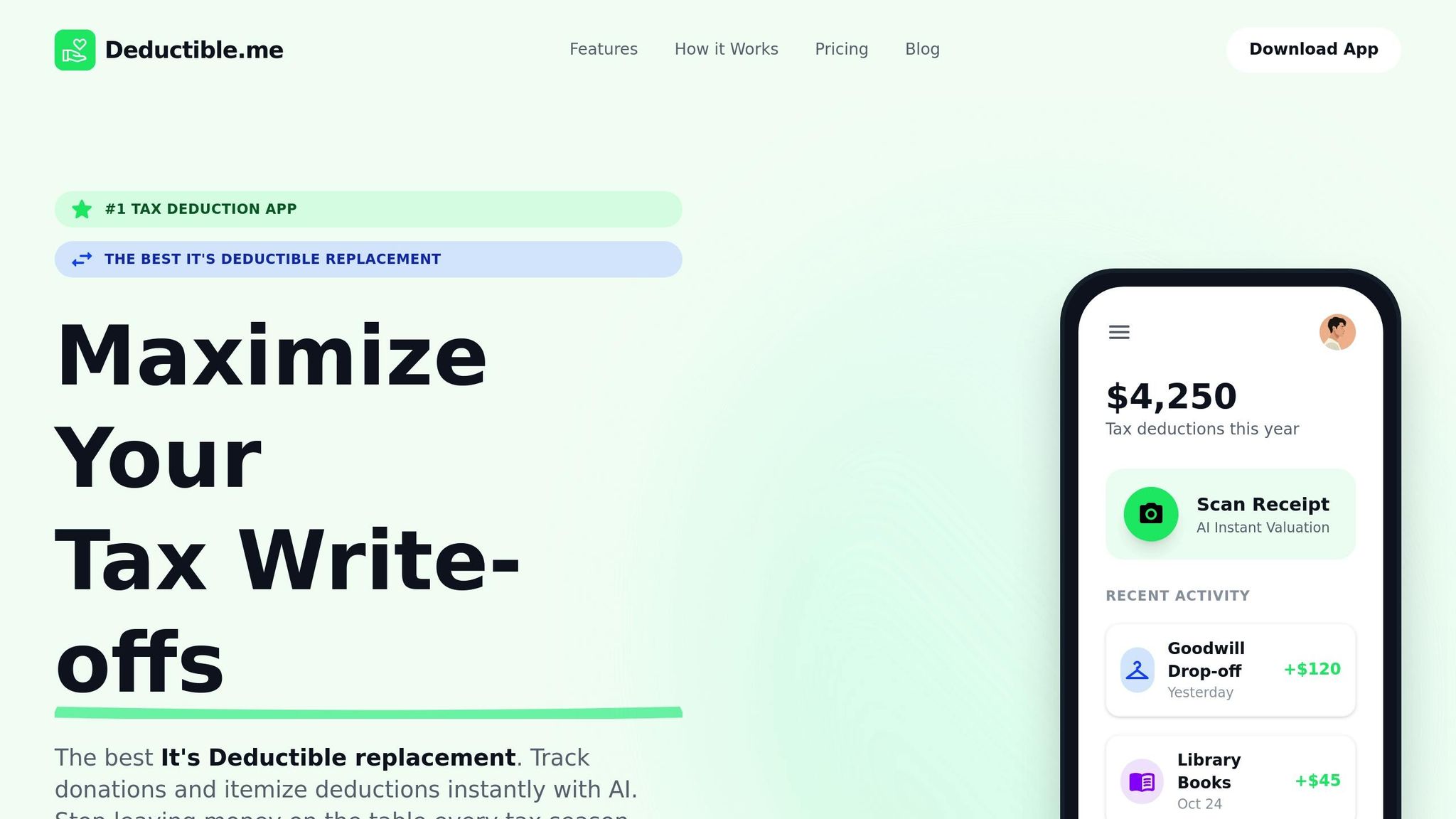

1. Deductible.me

Tackling the hassle of manual donation tracking, Deductible.me simplifies the process with smart tools for managing contributions and staying IRS-compliant.

Donation Tracking Features

Deductible.me makes tracking donations effortless with its AI-driven photo scanning feature. Just snap a photo of items like clothing, household goods, or other non-cash contributions, and the platform assigns values based on IRS Publication 561 guidelines [2][5]. It keeps tabs on both cash and non-cash donations throughout the year, so nothing slips through the cracks [3]. For volunteers, it records expenses and mileage at the IRS-approved rate of 14¢ per mile [2], while also organizing transactions for easy reference [6]. This thorough tracking ensures your records are accurate and ready for IRS requirements.

IRS Compliance Tools

Deductible.me goes beyond tracking by helping you meet IRS standards. It verifies the 501(c)(3) status of every recipient using the IRS Tax Exempt Organization Search Tool [4][1]. This ensures your deductions align with IRS rules. For non-cash contributions over $500, the platform generates reports that are ready for Form 8283 [2][4]. It also prompts you to upload written acknowledgments for donations of $250 or more [4][1]. Plus, it ensures donated items meet the IRS's "good used condition or better" requirement and helps you determine fair market values at the time of donation [4][9].

Pricing Options

The free plan allows users to track up to $500 in donations [10]. If you donate more, the Premium plan costs just $2 per month and offers unlimited tracking, advanced analytics, goal-setting tools, and priority support. Both plans include features like AI-powered valuation, receipt organization, and IRS-compliant reporting, making it a practical tool for donors of all levels.

2. CharityDeductions.com

CharityDeductions.com takes automated donation tracking a step further by incorporating live market data to provide more precise valuations. By pulling data from platforms like eBay and thrift stores, it offers users a range of valuation options - high, medium, and low - that reflect current market trends[12]. This ensures that your donation values are not just estimates but are tied to real-world data.

Donation Tracking Capabilities

The platform simplifies tax reporting by generating exportable tax reports. It continuously updates valuations based on real-time market data, keeping your records accurate and up to date.

IRS Compliance Features

CharityDeductions.com goes the extra mile to ensure compliance with IRS standards. It verifies that donation recipients qualify under IRS rules, such as 501(c)(4) nonprofits, religious organizations, and educational institutions[5][8]. Additionally, it confirms that donated items - like clothing and household goods - meet the IRS requirement of being in "good used condition or better"[1]. The platform also records receipts for cash donations and stores written acknowledgments for contributions over $250, helping you stay organized and audit-ready[11][7].

Pricing and Value

This tool is designed with IRS recordkeeping requirements in mind, making it a reliable choice for anyone looking to safeguard their deductions. By combining market-based valuations with clear compliance tools, CharityDeductions.com helps you maximize your legitimate tax savings while staying within the rules.

Up next, the TaxSlayer Donation Tracker offers another option for streamlined donation management.

3. TaxSlayer Donation Tracker

TaxAct's Donation Assistant sets a high bar for donation tracking tools, offering features that simplify the process of managing charitable contributions. Here’s a closer look at how it works.

Donation Tracking Capabilities

The TaxAct Donation Assistant takes the hassle out of tracking donations by automating the entire process. It assigns fair market values (FMV) to over 1,300 donated items, removing the need for guesswork. Plus, users can store digital copies of receipts and photos of donated items directly within the platform. This means you’ll have a complete, organized record that meets IRS documentation standards - all in one place [13].

IRS Compliance Features

One of the standout features is the integrated FMV database, which ensures that assigned donation values are consistent with standard market rates. This reduces the risk of errors that could attract unwanted IRS attention. By automating calculations and recommending accurate values for thousands of items, the tool helps users stay aligned with IRS guidelines [13].

Pricing and Value

Built with tax optimization in mind, this assistant simplifies recordkeeping and ensures you’re ready for tax season. By consolidating all your donation records into a single, easy-to-access location, it eliminates the last-minute scramble to piece together your charitable contributions [13].

sbb-itb-e723420

Comparing the Options

Comparison of Top 3 It's Deductible Alternatives: Features and Pricing

Selecting the right donation tracker boils down to how well each tool handles donation tracking, complies with IRS requirements, and aligns with your budget. Here's a closer look at how the leading options stack up.

Deductible.me uses AI-powered photo scanning to automatically recognize and assign values to donated items, saving you time and effort. The free plan allows tracking up to $500 in donations, while the Premium plan, priced at $2/month, offers unlimited tracking, advanced analytics, and additional features. It also generates IRS-compliant reports, such as Form 8283, and helps you set annual giving goals to streamline your charitable contributions.

CharityDeductions.com relies on live market data to automate valuations. It provides fair market value estimates for commonly donated items and creates the necessary tax forms, making it a solid choice for donors who prefer precise control over their records.

TaxSlayer Donation Tracker offers a comprehensive set of tools for managing charitable contributions. It includes a detailed database of items with pre-assigned fair market values, supports storing digital receipts and photos, and calculates donation values automatically, ensuring accurate recordkeeping.

Each tool has its strengths, so the right choice depends on your donation habits and preferences. If you donate frequently and value automation, an AI-driven option like Deductible.me could save you time. For those who prefer hands-on control, CharityDeductions.com offers detailed guidance. And if you're already using tax software, an integrated tracker like TaxSlayer Donation Tracker can simplify your workflow by keeping everything in one place.

Conclusion

Finding the right donation tracker comes down to matching your donation habits with the tool's capabilities. Whether you need AI-powered automation, real-time market valuations, or seamless tax software integration, there’s an option for you. For instance, Deductible.me uses AI photo scanning to cut down on manual entry, CharityDeductions.com offers precise valuations with live market data, and TaxSlayer Donation Tracker works directly with tax preparation software.

Cost is another important factor. With nearly 90% of taxpayers opting for the standard deduction instead of itemizing [14], a free tracker may be all you need if your annual donations total less than $500. However, if you’re a frequent donor and might cross thresholds requiring Form 8283, investing in a paid tool can save you hours of effort and help minimize errors during tax season.

Switching from tools like It’s Deductible is straightforward. Most platforms let you import past donation records, so you’re not scrambling to organize everything at the last minute. And if you’re donating items worth over $5,000, keep in mind that the IRS mandates a qualified appraisal. A good tracker will help you stay on top of these requirements, ensuring you have the necessary documentation to avoid issues.

Ultimately, the best donation tracker is one that saves you time, keeps you IRS-compliant, and helps you maximize your deductions. Align its features with your donation habits and documentation needs for the best results.

FAQs

What features does Deductible.me offer for tracking charitable donations?

Deductible.me makes tracking your charitable contributions simple and secure, no matter the type of donation. Whether it's cash, non-cash items like bonds or mutual funds, or even mileage for volunteer travel, you can log everything conveniently from any device. You can also attach photos of receipts or donated items, keeping all your records in one place.

A standout feature is its valuation engine, which estimates the fair-market value for over 1,700 commonly donated items. This helps you get a clearer picture of their resale value and potential tax benefits. Additionally, the platform updates your estimated tax savings as you log new donations, letting you see the financial impact of your generosity in real time.

When tax season rolls around, Deductible.me simplifies the process by seamlessly integrating with TurboTax. It automatically imports your tracked contributions into forms like Schedule A and Form 8283, saving you time and reducing the chance of mistakes. It’s a smart way to make sure you’re maximizing your charitable tax deductions with ease.

How does CharityDeductions.com determine the value of donated items?

It seems that CharityDeductions.com doesn’t provide detailed information about how they calculate or verify the fair market value of donated items. Without insight into their process, it's hard to determine how they ensure the accuracy of their valuations. If you come across any additional details or sources about their methods, feel free to share them, and we can delve deeper into explaining their approach.

Does TaxSlayer’s Donation Tracker work with other tax software?

Currently, there’s no clear information indicating whether TaxSlayer’s Donation Tracker works with other tax software programs. For the most accurate and current details about compatibility, it’s best to reach out to the provider directly.